Defined Contribution Pension Plan

For HWSL & Corby employees hired after July 1, 2010

Whether you’re thinking about your family, career, education, retirement, or more, your Canada Life group retirement and savings plan can help provide you with the tools and support you need to feel confident about your future. View the “Retirement - Are you on the right track?” education session to learn more about your DC Pension & Retirement Savings Plans, hosted by Canada Life, to help support you with reaching your retirement savings goals.

*For employees hired prior to July 1, 2010 you may be entitled to a benefit from a Defined Benefit Pension Plan instead of the Defined Contribution Pension Plan. Please contact Eckler by phone at 1-888-571-3245 9:00 a.m. to 5:00 p.m. Eastern Time Monday through Friday or email at CorbyHWSLpension@eckler.ca to inquire about your Defined Benefit Pension Plan and receive more details.

The following are highlights of the Plan:

• You are eligible to participate in the plan following 90 days of employment.

• Pensionable earnings include regular base pay, retro pay, lump sum merit and excludes bonus pay.

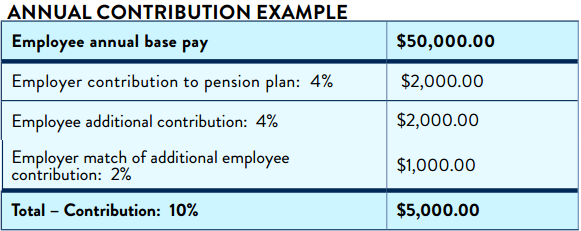

• The employer automatically contributes 4% of pensionable earnings.

• The employee has the option to make an additional member contribution of 1% to 12% of pensionable earnings as a whole number integer.

The employer will match the first 2% of additional member contributions at 100%.

• The maximum combined employer and member contribution is 18% of pensionable earnings.

• Employer contributions vest immediately upon enrollment.

To change your contribution percentage, you will need to update it directly through your Canada Life account.

A detailed summary of the Plan provisions and enrollment forms are located under Resources.